April 2024

State doesn’t set your insurance premiums

Consumers often tell the Texas Department of Insurance (TDI) that their insurance company or agent told them that their premium went up because the state made them raise rates. TDI doesn’t set the homeowners or auto insurance rates that your insurance company charges.

Insurance companies can change their rates and premium formulas by sending them to TDI. This is called a “rate filing.” Companies can use the new rates as soon as they send them to TDI.

Companies are required to provide an analysis that supports the rate changes they file. TDI staff review the analysis and ask for more information, if needed, to evaluate whether the rate changes are supported and follow state law.

By law, rates must be adequate; not be excessive; be based on sound actuarial principles; be reasonably related to all costs; and not be based on the insured’s race, creed, color, ethnicity, or national origin.

If your auto or home insurance bill is rising, ask your company to explain the increase and if you’re getting all available discounts.

You might want to shop for a better deal.

You can start your search at HelpInsure.com to get sample estimates. Then call companies to get price quotes.

You might want to call an independent insurance agent. They can help make sure you’re comparing the same type and amount of coverage.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

March 2024

Five steps to getting your insurance claim paid

Tips for getting your insurance claim paid:

- Make your claim. Submit your claim, along with photos and videos of all damage, to your insurance company or someone else’s company. Start by telephone or email—or go online or use a company app. Keep receipts for all your expenses.

- Answer questions. The insurance company will ask follow-up questions. Answer fully and quickly. You might see an adjuster in person. If you do, get their name, phone number, and email address to have handy. Take notes on every communication.

- Be aware of deadlines. Your company has 15 business days to say it’s received your claim. It has 15 more days after getting all the information it needs to decide if it’ll pay. If your claim is rejected, the company must say why in writing. If your claim is with someone else’s company, that company doesn’t have the same time limits, but should treat you fairly.

- Choose a contractor. You may take your car to any repair shop. If you’re choosing a contractor, get bids from several. Don’t sign any contract with blank spaces. Don’t pay in full up front.

- Get paid. If you’re using your own insurance, your company will subtract your deductible from your claim payment. You owe the deductible to the contractor or repair shop. Once an insurer agrees to pay, it has five business days to get at least part of the payment to you. If your claim is with someone else’s company, there’s not a time limit, but it should try to make a prompt and fair settlement.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

February 2024

Ready to get in shape? Your health plan could help

You know that your health plan backs medical care.

Your plan also might help you get fit.

Check your plan’s website or call your agent to see if your plan offers:

- Free or discounted weight loss or wellness programs.

- Free or discounted programs to help quit cigarettes and other tobacco products.

- Discounts on gym memberships.

- A free app to help you count steps and track your fitness.

Your plan also might have discounts on personal training, massage, and acupuncture.

Similarly, your workplace might have wellness incentives. Some employers offer coaching by phone or health screenings. Check with your human resources department.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

January 2024

Space heater on? Know these safety tips

A space heater is a great way to warm yourself up in the winter months if you go about it safely.

“We see several fatal fires around this time of year that involve a space heater,” said Debra Knight, the state fire marshal. “Most of them are accidental and could have been avoided by following some basic safety steps.”

To avoid setting an accidental fire with a space heater, follow a few safety tips:

- Inspect the heater to make sure it has no loose wires or cracked or broken plugs. If so, replace the heater.

- Always plug your heater directly into a wall outlet. Avoid extension cords or power strips.

- Reduce risk by keeping your heater at least three feet from anything that can burn, including furniture, blankets, or mattresses.

- Turn off your heater before you leave the room or go to bed. The best way to be sure: Unplug it.

- Never use or store flammable liquids in the same room as a space heater. And because heaters are electric, don’t get near one when you’re wet.

Heating equipment, including space heaters, are the third leading cause of home fire deaths behind smoking materials and cooking. Space heaters account for more than 15% of all home fire deaths.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

December 2023

Get your home ready for a winter freeze

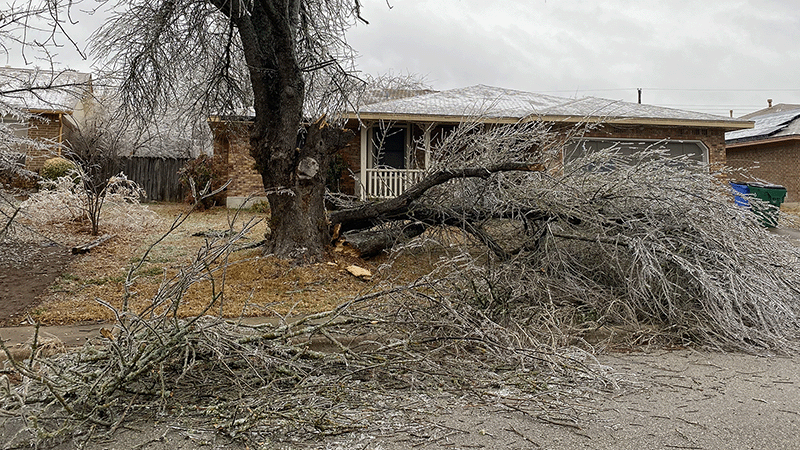

In 2021, snow and frigid weather caused billions of dollars in damage resulting in hundreds of thousands of Texas insurance claims.

Take these steps now to protect your property in advance of freezing temperatures:

- Trim trees that have branches hanging over your house or cars.

- Seal leaks or cracks around bathroom and kitchen pipes.

- Test your carbon monoxide and smoke alarms. Replace alarms that are 10 years old or more. If your battery-operated alarm has no date label, it’s outdated; replace it.

- Get your chimney inspected and cleaned. Creosote buildup can start a fire.

- Learn where your water shut-off valve is outside. It’s usually in an underground space under a cover near the street.

If freezing weather is in the forecast, you can:

- Cover outdoor faucets and exposed pipes. Also cover indoor pipes in unheated areas, like an attic or a garage.

- Run water through your indoor faucets – hot and cold – before you go to sleep. Or you can let faucets drip from the taps.

- Drain lawn sprinkler lines leading into your home.

- Turn off the water at the shut-off valve if leaving your house before a possible freeze. Also, leave your heat on.

If your pipes burst, your homeowners insurance could help. Most insurance pays for “sudden and accidental” damage. Frozen pipes and broken appliance hoses are common examples.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

November 2023

Keep your family safe from carbon monoxide

There’s a good chance you have a natural gas, propane, or wood burning appliance in your home. Are you protected against carbon monoxide?

Carbon monoxide is deadly to humans and pets. You can’t see, taste, or smell it.

These tips will help keep you and your family safe:

- Install a carbon monoxide alarm in your house. It’s also a good idea to get a portable alarm for when you travel.

- Test your alarm monthly.

- Don’t use a stove to heat your home.

- Don’t use a charcoal grill inside.

- Keep your fireplace clean, and always open the flue when you use it.

- Don’t leave your vehicle running in the garage, even with the door open.

- Don’t run a portable generator in or near your home. Make sure it’s 20 feet away from open doors and windows.

- If your alarm sounds, move outdoors immediately and call 9-1-1.

Have a question about fire safety? Call the State Fire Marshal’s Office at 800-578-4677 or visit www.tdi.texas.gov/fire.

September 2023

Hail damage? Tips to file an insurance claim

Did hail or strong winds damage your home or car?

If you have wind and hail coverage on your home policy or comprehensive coverage on your auto policy, your insurance company should pay for your hail damage.

File a claim as soon as you can.

Some claim tips:

- Take photos and video of the damage. Also, make a list of the damage inside and outside your house or car. Don't throw away damaged items until your insurance company gives permission.

- Prevent more damage. Remove standing water. Cover broken windows and holes to keep out rain. Save all receipts. Your policy may pay for temporary repairs.

- Be available for the adjuster visit. Make sure they see everything.

- Keep a list of everyone you talk to at your insurance company. Be ready to answer questions about the damage.

- Ask about living expenses. If you can’t stay in your house, most policies will cover some related costs. Keep your receipts.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

September 2023

How to get home insurance discounts

Do you want to lower your home insurance costs?

Make sure you’re getting all your discounts.

Ask your insurance agent or company about possible discounts such as a:

- Safe home discount, especially if you have a security alarm.

- Smoke alarm or sprinkler discount.

- New home discount. If your home was built or renovated in the last five years, your insurance company might reduce your premium.

- Roof discount. Companies often offer discounts for roofs made of materials that help prevent damage or resist fire. Homes with newer roofs may get a roof age discount.

You also might get a discount for having multiple policies with the same company.

Also, shopping different companies could pay off. Get sample rates at the Texas Department of Insurance’s HelpInsure.com.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

August 2023

Life insurance can help

If your loved ones financially depend on you, you might want to buy life insurance.

Proceeds from a life insurance policy can cover burial expenses. And beneficiaries could use the money to help pay mortgage or tuition costs.

Some policies provide benefits to you while you are alive.

There are two basic types:

- Term life insurance is the simplest and least expensive. It covers you for a set number of years—until age 60, for instance.

- Permanent life insurance provides coverage throughout your life as long as you pay your premiums. These policies are complex, so it’s a good idea to talk with a financial planner.

Need to track down a missing life insurance policy? You can search for a policy or annuity through the National Association of Insurance Commissioners.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

July 2023

Tornado watch or tornado warning? Big difference

A tornado watch is not the same as a tornado warning.

The big differences:

- A tornado watch tells you to keep an eye out for a possible tornado. Pay close attention to local sources of weather information.

- A tornado warning means a tornado’s been recently spotted in your area.

Warning

If you hear a tornado warning, immediately take cover. If you’re in a car, truck, trailer, or mobile home, get out and enter the closest building.

If you’re driving, don’t stop under bridges or overpasses. They don’t protect you from winds or flying debris.

If you’re caught outside and can’t get to a building, lie flat and face down in the nearest ditch or depression. Cover your head with your hands.

If you’re in a house or other building, go to an interior room, bathroom, or closet on the lowest level. Cover yourself with blankets, towels, or a mattress.

Don’t open windows; it doesn’t help equalize pressure. Also, shut all your doors; this could reduce the chances of your roof blowing off.

Watch

If you hear a tornado watch, tune in to your local weather report to keep track. Get ready to move to a safe space.

A tornado watch area is often large. It can include multiple counties, even whole states.

Under a tornado watch:

- Review your emergency plans.

- Bring in or secure outdoor objects that could blow around.

- Check supplies such as batteries, flashlights, water, nonperishable food, and medicines.

- Identify your safe room.

Summing up: A tornado watch means get ready. A warning means move—now—to safety.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

June 2023

Your portable generator can keep your family safe

Using a portable generator can keep major appliances working during a power outage.

Just remember to use it safely.

Protective tips:

- Place your generator outdoors, at least 20 feet from your home’s doors, windows, or vents. Keeping distance helps protect you from carbon monoxide gas, which is colorless, odorless, and potentially deadly.

- Let your generator cool down before refueling.

- Don’t store fuel inside your home.

- Plug appliances directly into your generator or use a heavy-duty, outdoor-rated extension cord. Check extension cords for cuts, tears, or missing prongs.

- If you want to connect your generator to your home’s wiring, hire a licensed electrician. Make sure the electrician uses a properly rated switch that meets electrical codes.

Another essential: Read your owner’s manual. This will help you avoid unnecessary risks.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

May 2023

Why you should consider a flood insurance policy

Most home insurance doesn’t cover damage from flooding after a storm.

Think you’re not at risk? Well, on average, 60% of all U.S. flood damage occurs in low-risk flood areas.

Even a small amount of water can cause thousands of dollars of damage. If you don’t have flood insurance, you’ll have to pay for those repairs on your own.

So, consider shopping for a flood policy.

Homeowners who get a standard National Flood Insurance Program (NFIP) policy can insure their home for up to $250,000 and also cover up to $100,000 in belongings. Renters can also get NFIP coverage for up to $100,000 in belongings.

With hurricane season starting in June, now is a good time to contact your agent or insurance company about buying a flood policy. Plans usually take effect 30 days after purchase.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

April 2023

Plan for changing insurance needs through life

Your first car could be just a dented memory — or you’ve found your dream house and expect to expand your family.

Life is change — which is also true of your insurance needs.

Some milestone insurance tips:

- Expecting a baby? If your health plan uses a network, make sure your doctor and hospital are in that network, which could save you money. Also, ask how much you’ll have to pay in other charges. See if your plan covers a breast pump, breastfeeding support, or post-partum counseling. And remember to add your new baby to your coverage. (And, by the way, congratulations!)

- Growing family? As your family grows, consider buying life insurance. It could give you peace of mind about future costs such as housing, childcare, education, and any medical needs if you aren’t around. If you and your spouse both contribute to the family’s finances, you’ll both need coverage.

- Off to college When heading to college, your premium could change if you’re driving your car far from home; check with your agent. For health coverage, you can stay on your parent’s plan until age 26. If you rent an apartment or house off campus, consider renter’s insurance; it will cover your stuff in the event of loss.

- Deploying for Uncle Sam Talk to your agent about your auto insurance if nobody will be driving your car while you’re serving or you’re leaving it in someone else's care. Save stress by setting up automatic premium payments on other insurance. Need more life insurance? Active-duty military personnel, including reservists and National Guard members called to active duty, are automatically insured for $400,000. To consider more coverage, get price quotes from several companies. The Department of Veterans Affairs has a life insurance needs calculation tool and information on plans.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

March 2023

5 tips to shop and save money on car insurance

To get the best deal on insurance, you’re going to have to shop from time to time.

Some cost-saving tips:

- Review your coverages. A change in how you use your car may affect your coverage and save you money. Think about the cost of keeping collision coverage on an older vehicle. Learn if working from home makes a difference in types of coverage you should have.

- Get auto coverage quotes from several companies and vendors. Some insurance is sold through company agents, some by independent agents and brokers. And you can buy directly online or by phone.

- Adjust your deductible. You can cut your premium by agreeing to a higher deductible. The deductible is what you’ll pay after a covered loss, before your insurance coverage kicks in. Carefully consider what you can afford.

- Ask about discounts. Companies might offer discounts, including if your teen driver has good grades.

- Check on bundling options. Total insurance costs can go down if you buy home, auto, or other coverages from one insurance company.

- Use HelpInsure.com to compare rates and coverages for companies that sell the most auto policies in Texas.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

February 2023

When a tree falls, does your insurance apply?

Will insurance pay when a tree crashes down on your car or house?

Sometimes.

If a tree or branch falls on your house or car, use these tips:

- Take photos of the damage before you move the tree, make repairs, or take other steps to prevent more damage.

- Make temporary repairs to prevent more damage, and contact your agent or insurance company as soon as possible.

- Save your receipts for reimbursement. Your homeowner policy should cover materials and labor used to make repairs.

Many homeowners policies provide some coverage if a tree falls in a storm and your house is damaged or limbs block your driveway.

But limbs and trees falling in your yard usually aren’t covered. Call your agent or company to check.

If your neighbor’s tree falls on your house, their homeowners policy probably won’t cover the damage and tree removal, unless your neighbor was at fault. Your neighbor isn’t responsible for acts of nature.

If your neighbor’s policy doesn’t pay, you can file a claim under your own policy.

If a tree falls on your car, your auto insurance will pay for damage if you have comprehensive coverage.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

January 2023

New year is a chance to clean up — and review your insurance

This new year might inspire you to clean your garage or tidy your shelves.

Good ideas! And when you’re done, why not review your insurance coverages? A little research could save you money and improve your benefits.

Use these tips to get started.

First off, if you moved or changed your phone number, make sure you told your health plan and your home and auto insurance companies.

For your health plan:

- Find out which nearby emergency rooms and urgent care centers are in your plan’s provider network. This could spare you time and money in an emergency.

- Ask your health plan or visit its website to find out if you can use a nurse phone line or a virtual doctor visit. Make a handy list.

- Check if your health plan has programs to help you lose weight or stop smoking. Your plan might even pay for a gym membership.

For your home and auto policies:

- Consider if you should drop collision and comprehensive coverage on an older car or truck that’s been paid off. It might not be worth having it. Your vehicle might be worth less than the coverage.

- Liability coverage is usually cheap. Ask how much it costs to increase your limits. The extra protection might be worth it.

- Ask your insurance company if you have enough coverage to rebuild your home after a disaster. Repairs are more expensive than they used to be.

- Did you make any changes to your home such as adding on, enclosing the porch, or upgrades to your heating and cooling? Make sure to tell your insurance company about them.

- Make a digital inventory of furniture, appliances, and other valuable objects in your home. This list could ease your recovery after a fire or other incident.

- Think about buying flood coverage. Homeowners policies don't cover flood damage.

- Shop around to compare insurance coverage and prices.

Finally, for any insurance, ask what discounts the company offers that could make the price cheaper.

Happy New Year.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

December 2022

Stop kitchen fires, protect your home

Most home fires start in kitchens.

Learn about preventing and putting out fires:

- Don’t walk away while food is cooking. If you have to leave, even for a short time, turn off the burner.

- If something catches fire on your stove, cover the pan with a lid to smother the flames. Leave the pan covered until it’s cool.

- If the fire is in the oven, turn off the heat and don’t open the door.

- Never pour flour or water on a cooking fire.

- If you have any doubt about fighting a fire, just don’t. Get away by going outdoors. When you leave, close doors behind you to help contain the fire. Call 9-1-1 from outside.

November 2022

Tips to buying a health plan—and getting what you want

Are you looking for health insurance for your family?

Some timely shopping tips:

- If you’re using HealthCare.gov, note these deadlines:

- You have until December 15 to sign up for coverage that starts January 1.

- You have until January 15 to sign up for coverage that starts February 1.

- If you are using HealthCare.gov, check if you can get a tax credit. Premium tax credits and subsidies are based on your income. Update this information and shop for a new plan each year. There are lots of changes for 2023, so you need to login to consider your options.

- If you have a health issue or doctors you like, make sure that any plan you consider includes your doctors in the plan’s network.

- If you take medication, make sure it’s covered by reviewing the plan's drug list. Call the health plan if you have questions about what’s covered.

- Review a plan’s out-of-pocket costs such as deductibles and copays. See if any services in addition to preventive care are covered before meeting the plan’s deductible.

- Ask the plan if you have to use doctors, hospitals, and urgent care centers in the plan’s network or if you can use any that you want. Ask what the cost difference is.

- Ask the plan if you’ll have to get permission from a primary care doctor to visit a specialist.

Use the Texas Department of Insurance’s “Health plan shopping guide” to help you decide on health coverage.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

October 2022

What to know about replacing your roof with insurance

Texas weather can batter a home’s roof. Before you replace your roof or make repairs, know how your insurance could help.

Ask your company or agent these questions:

- Replacement cost or actual cash value? When you buy or renew your home insurance policy, ask how they pay for roof damage and replacement. Some policies pay the full cost to repair the roof. This is called replacement cost coverage. Some policies pay less if the roof is older or showing wear. This is called actual cash value coverage.

- Does insurance always cover roof replacement? If your roof is in poor condition, your company might not pay. Ask your company if your policy has roof coverage. If you replace your roof, consider roofing materials resistant to wind, hail, or fire. You might get an insurance discount.

- What’s my deductible? A deductible is what you pay before your company will pay. Your deductible for wind and hail damage might be different from your deductible for other damage. If it is, you could pay more up front for repairs.

- When should I file a claim? You can file a claim if a storm, tree, or something else damages your roof.

September 2022

Are you ready?

You already know … Planning for a disaster when a disaster is heading your way isn’t ideal and could be too late. You need to prepare now. Here are some easy steps:

- Install a weather app on your phone. Turn on notifications or check it before bad weather to know what’s headed your way.

- Make an inventory of the stuff in your house. Email it to yourself or keep it somewhere else online. Include item model and serial numbers. Take photos or videos of each room in your house, including closets and drawers. If you need to file a claim, the list and photos will help.

- Pack a “go bag” of supplies you can grab if you need to leave in a hurry. Include water, food, clothes, chargers, medicines, and pet supplies. Have copies of your home, auto, and health insurance cards.

- Consider buying flood insurance. Your home insurance policy doesn’t cover flood damage; you need a separate flood policy. Most flood policies have a 30-day waiting period before you can file a claim.

- Check that your insurance policies are up to date and provide enough coverage. Your coverage limits might be too low if you’ve built onto your house or bought new furniture or electronics.

Learn more:

Do you have enough home insurance?

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

August 2022

Spacecraft hit your home? Most insurance covers that.

Maybe you heard; NASA plans a year-long study of reported UFOs.

But did you know that most home insurance policies would pay if a spaceship hit your house?

Really.

In the unlikely event a spacecraft damages your home, most home policies would pay for damages. Falling objects is a “covered peril.”

Here’s what else your home policy probably covers—and doesn’t:

- Damages from hail or fire are covered.

- Tornado and inland hurricane damages are covered. If you live near the Gulf Coast, you’ll likely need a separate windstorm policy.

- Most policies cover water damage from leaks and broken pipes, but there are exceptions. Read your policy to see what’s covered.

- Most policies do not cover damage from water that comes from outside your home. You’ll need a separate flood policy.

- Damages from earthquakes are not covered. Neither are termites, wear and tear, and sewer backups.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

July 2022

Leave July 4 fireworks to the professionals

Love fireworks? To stay safe, let a professional light up your Independence Day.

State Fire Marshal Orlando Hernandez advised: “If you want to see great fireworks, go to a professional show. Our office has issued many permits for communities to enjoy Fourth of July shows. So, you should have one nearby.”

Another caution: Your county might be under a burn ban. Most communities don’t allow you to use fireworks within city limits or during burn bans.

Check with your local fire department to see what’s allowed.

“Also, there are no safe fireworks for children,” Hernandez said. “Some sparklers burn at temperatures of nearly 2,000 degrees, as hot as a blow torch.

“Celebrate,” Hernandez said, “and stay safe.”

Want to learn more about fireworks safety? Visit the Texas Department of Insurance’s website at www.tdi.texas.gov.

June 2022

Hurricanes predicted? Here are 5 tips to prepare.

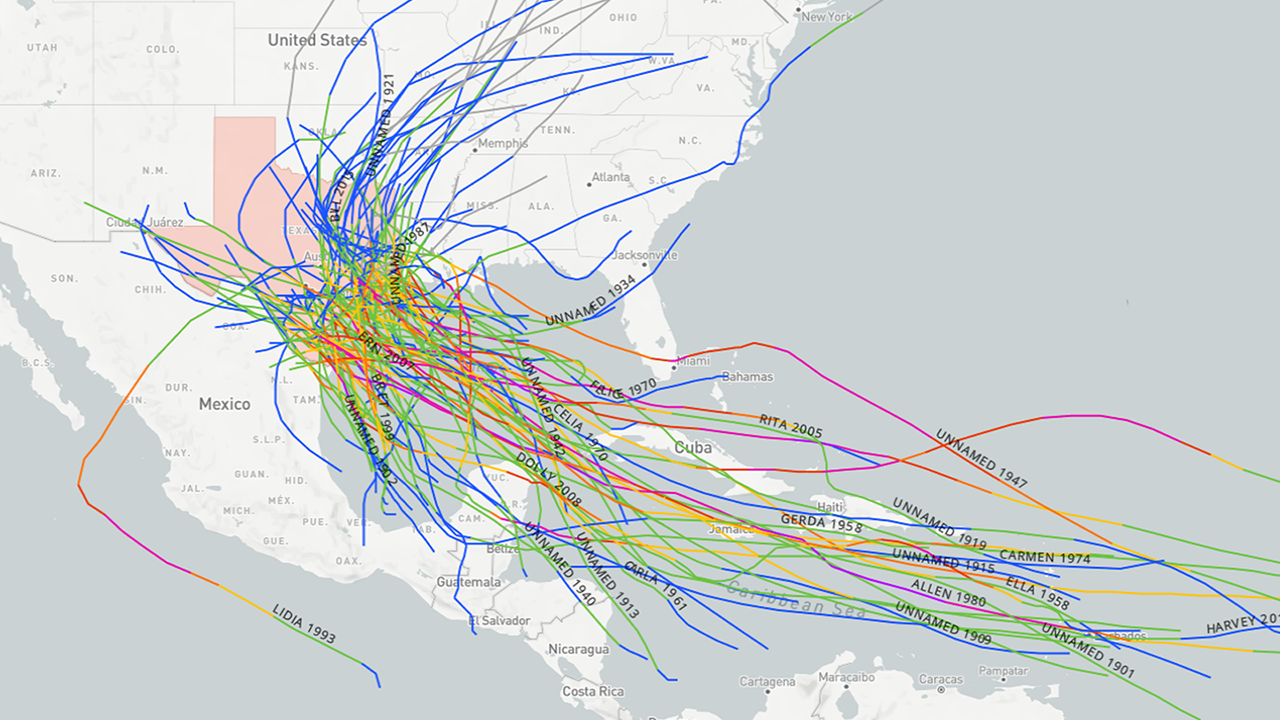

Texas and the U.S. could be in for another busy hurricane season, which runs from June through November.

The National Oceanic and Atmospheric Administration predicts up to 10 hurricanes. Colorado State University experts forecast 9 hurricanes and they say there’s a 54% chance that a hurricane comes within 50 miles of the Texas coast.

Some tips to prepare:

- Consider buying flood insurance. Flood damage isn’t covered by your home insurance. Don’t wait long: flood policies typically don’t take effect for 30 days after purchase.

- Write a family disaster plan. Start from the TexasReady.gov website.

- Decide where and how far you’ll go if you have to evacuate.

- Build a “go-kit” with food, medicine, clothes, pet food, and other vital supplies.

- Make a room-by-room home inventory (PDF). This could help later if you file a claim.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

May 2022

How to avoid getting struck by lightning

Shocking fact: Lightning can strike 10 miles away from rain.

In any given year, your chances of getting struck by lightning are slim. Of course, if you ignore the dangers of thunderstorms your chances of getting hit go higher.

Heed these tips and avoid zaps from the sky:

- If you’re outdoors and you see lightning or hear thunder, go inside a sturdy building or get inside a hard-top car or truck and close the windows.

- Avoid utility poles, barbed wire fences, tractors, and motorcycles.

- Don’t lie flat. If your hair stands on end, squat down and put your head between your knees.

- If you’re indoors, stay away from plugged-in appliances and don’t take a shower or bath, wash dishes, or stand near plumbing. Water pipes conduct electricity.

Learn more:

- Thunderstorms: How to protect yourself from lightning

- 5 Tips for lightning safety

- Texas town listed as the US lightning strike capital

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

April 2022

Want to save money on car insurance?

People routinely price-shop food, clothes, tech products, and other items.

It also pays to shop around for insurance. Companies charge different rates and the company you’re with might have raised rates. Insurance companies want your business, and you often get the best rates when you’re willing to switch companies.

Do companies have discounts to help lower the cost?

Yes! Some companies offer discounts if you have a good driving record. There are also discounts for having an alarm on your car, taking defensive driving or driver’s education courses, and having more than one car on a policy. Companies have a lot of discounts, so ask your agent what type of discounts they offer.

What about lowering my deductible? Would that save money?

A deductible is the amount you must pay before the insurance company will pay. A lower deductible generally means that you’ll have to pay more for the policy. You’ll want to think about how much you can afford to pay if your car is damaged.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

March 2022

Get a CLUE about the insurance history of a home or car

Wondering how much it will cost to insure that home you’re thinking of buying? Or if a used car you’re interested in has been in a major accident?

You can check by getting a report that reveals the insurance history of a home or car.

What’s the report? It’s the Comprehensive Loss Underwriting Exchange or CLUE report. It shows claims filed for homes and cars for the past seven years—even if you weren’t the owner. Insurance companies are supposed to report information based on filed claims, including:

- Date of loss

- Loss type

- Amount paid on claim

How do I get a report? If you’re buying a home or car, you can ask the current owner for the report.

Each year, you can get a free report on property you own by contacting LexisNexis. You also can contact LexisNexis to dispute information in the report or to add an explanation.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

February 2022

Surprise doctor’s bill? You might not have to pay it.

A surprise bill from a doctor or other medical provider can be unwelcome.

Good news: You might not have to pay it.

A new federal law and 2019 state law ban surprise billing in emergencies or when you didn’t have a choice of doctors. Federal law also protects you from surprise bills from air ambulance services.

If you get a surprise bill, visit the Texas Department of Insurance website, www.tdi.texas.gov and click on “ Get help with a surprise medical bill.”

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

November 2021

Outdoor burning: What to know before you light the match

If you plan to light an outdoor fire this fall, remember to check first with your city and county about burn bans and local fire rules. Check the Texas burn ban map to see county burn ban information maintained by the Texas A&M Forest Service.

Statewide, Texas limits outdoor burning to:

- Campfires, bonfires, fire pits, and cooking fires.

- Household trash fires on your home property—only if you lack trash pickup.

Most wildfires start from carelessness. Control your fire by putting trash, grass, leaves and branch trimmings in a burn barrel or similar container. Top it with a screen or metal grid.

Also, keep water, a shovel and a rake handy in case your fire starts to spread. Finally, stay by your fire until it’s out.

Certain items should never be put in a fire—such as aerosol cans or anything that could explode; electrical insulation; building/construction materials including treated lumber; and plastics and asphalt-based materials.

If you spot a dangerous fire, call local law enforcement. You may also call the Texas Commission on Environmental Quality at 888-777-3186.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

October 2021

Trying to find mental health services? Help is available

Each year, nearly one in five adults experiences a mental health illness. But fewer than half get treatment. Knowing treatment options—including those available through your health plan—can help you or a loved one.

Most comprehensive health plans must cover mental health services—and with no lifetime caps on benefits. And plans that cover mental health services must provide the same level of benefits, such as copays or access to emergency care, as they do for a physical illness or injury. You also may benefit from mental health help lines, telemedicine care, and other valuable services.

If your request or claim for mental health services is denied, ask why. Your health plan will have a way for you to review and appeal denied claims. You can also request an external review by an independent third party—at no charge to you. The Texas Department of Insurance can show you how external reviews work.

TDI’s website provides even more information on mental health coverage, including links to hotlines and how to get help.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.TDI.texas.gov.

September 2021

Do your social media posts make you a target for identity theft?

If you use social media to keep in touch with friends, you might be risking identity theft.

Tips to protect yourself from identity theft:

- Never post a photo of your driver license or ID card. It could include your birthdate and other personal data.

- Watch out for quizzes that ask for personal information. Scammers ask questions to get information you already use to log in to bank or credit card accounts.

- Protect other family members. Teens are most likely to overshare online. They usually have clean credit histories, which makes their identities valuable. Older relatives don’t use social media as often. But they might not know when they’ve been hacked. Check the accounts of family members in these groups.

- Consider identity theft insurance – which might already be included in your homeowners or renters policy.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

August 2021

My car was totaled! Now what?

Was your car declared a total loss after an accident or flood? Here are some answers to questions you might be asking.

What does ‘totaled’ mean? Your insurance company compares the value of your car and the cost to repair it. If the repair costs are about the same or more than the car’s value, it will likely consider the car totaled.

What if I think my car is worth more? If you think your car is worth more than the insurance company is offering, you can try to negotiate. Be prepared to show what a car like yours would sell for in your area:

- Get quotes from used car dealers.

- View prices online and look for local ads for similar vehicles.

- Document special features or custom parts on your car.

Can I fix my car instead? To keep your car, let your insurer know quickly. The company will subtract the car’s salvage value from the amount it was planning to pay you. The car also may be issued a salvage title, which could make it harder to insure or sell later.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

July 2021

Is your house ready for your vacation?

Planning an out-of-town trip? Before heading out, take time to make your home is as safe as possible:

Set timers on interior lights. Criminals look for easy targets. Use a timer on a few lights to make it appear someone is home. Also, don’t let newspapers or mail pile up. Make sure valuables aren’t visible to someone looking through windows, and don’t leave a key outside.

Don’t post on social media. It’s wise not to post online that you’re away even if you think only friends and family can see your social media updates.

Lock doors and windows. This seems obvious, but it’s easy to overlook. Before you leave, walk around the house to make sure everything is locked.

Unplug TVs and computers. It’s Texas. So you never know when an electrical storm could cause a power surge. To protect expensive electronics, unplug them or plug them into a surge protector.

Turn off the main water supply to your home. Even a minor leak can cause major damage if no one is home to catch it.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

June 2021

After you marry, look for insurance savings

If you’re getting married, we can’t you help find a caterer or band.

But this insurance checklist could help you save money:

- Renters insurance: The average Texas renters policy costs about $20 a month. That’s an affordable way to protect your wedding gifts. The coverage will pay to replace items damaged by a burst pipe, fire, or other cause. It also will cover personal items stolen from your home or car.

- Auto policies: Combining your auto policies may save you money. Most insurance companies offer a discount if you cover more than one vehicle. Also, rates are usually lower if you’re married.

- Health coverage: You have options. If both of you have coverage through work, compare policies. One may offer better benefits, a lower deductible, or a lower cost to add a dependent. Check if there’s a deadline to add a spouse.

- Life insurance: Life insurance helps your spouse and family maintain their standard of living after you die. Consider how much income would need to be replaced to help with childcare, your mortgage, and other debts.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

These columns by the Texas Department of Insurance are available for use in publications. They may be edited as needed and used without copyright. For questions, contact TDI media relations at 512-676-6595 or MediaRelations@tdi.texas.gov.