February 2026

Insured Texas drivers have a consumer bill of rights

When you insure your car or truck, you get lots of information—including a Texas consumer bill of rights for auto insurance.

Too much information? Let’s make this easier.

In Texas, you have the right to:

- Call the Texas Department of Insurance (TDI) for information and help with a complaint against an insurance company.

- Choose the repair shop and parts for your vehicle. An insurance company can’t tell you or the body shop what brand, age, vendor, or condition of the parts you can use. They also aren’t required to pay more than a reasonable amount.

- Ask your insurance company about your policy. The company can’t use your questions to determine your premium or deny, non-renew, or cancel your coverage. You can ask questions about your policy, the company's claims filing process, and whether the policy will cover a loss—unless the question is about damage that results in an investigation or claim.

- Dispute the amount of your claim payment or what your policy covers. Contact your insurance company or the body shop. You can also ask an attorney or appraiser to look at the damage.

- Cancel your policy any time and be refunded the remaining premium.

- File a complaint with TDI.

Read the full bill of rights (PDF) on TDI’s website.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

January 2026

Look at your plan on HealthCare.gov before enrollment ends

The Texas Department of Insurance (TDI) advises Texans with health insurance through HealthCare.gov to log on and look at their plan.

Plans change every year, so the price might be different. If the price isn’t right, you can switch plans until January 15 when open enrollment ends.

TDI has resources to help you shop for coverage and avoid scams.

Some highlights:

- Look at your plan to know how much you’ll pay in premiums, copays, and deductibles.

- If you switch plans, ask if the new plan lets you see your current doctors and covers your medications.

- If you buy a plan on a website other than HealthCare.gov, know what you’re buying. Alternative health plans have fewer benefits and more limits than traditional health insurance.

You can call our Help Line with general questions about insurance at 800-252-3439.

December 2025

Compare and choose a health plan using Texas Health Plan Compare

Wondering how to pick among Texas health insurance plans?

Say whether you use tobacco and share your birth date and home county, then the Texas Health Plan Compare website lists locally available plans. When you're ready to buy, you can go to Healthcare.gov or buy a plan on your own.

For each plan, you’ll see:

- The company offering the plan, the plan type, and the coverage level.

- The total monthly premium (before any tax credit you might get on HealthCare.gov).

- Your copay amount for a doctor or specialist visit.

- Your deductible; how much you pay up front each year before the plan pitches in.

- The maximum amount you will have to pay out-of-pocket each year for medical services.

- The percentage of complaints people filed about the insurance company.

Next, you can click to compare plans. The results also give you access to each plan’s list of covered drugs and directory of doctors and hospitals.

Ready to roll? Go to the site’s guide to choosing a plan.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

November 2025

Stop kitchen fires, protect your home

Most home fires start in kitchens.

Learn about preventing and putting out fires:

- Don’t walk away while food is cooking. If you have to leave, even for a short time, turn off the burner.

- If something catches fire on your stove, cover the pan with a lid to smother the flames. Leave the pan covered until it’s cool.

- If the fire is in the oven, turn off the heat and don’t open the door.

- Never pour flour or water on a cooking fire.

- If you have any doubt about fighting a fire, just don’t. Get away by going outdoors. When you leave, close doors behind you to help contain the fire. Call 911 from outside.

September 2025

Outdoor burning: What to know before you light the match

If you plan to light an outdoor fire, check first with your city and county about burn bans and local fire rules. Check the Texas burn ban map to see county burn ban information maintained by the Texas A&M Forest Service.

Statewide, Texas limits outdoor burning to:

- Campfires, bonfires, fire pits, and cooking fires.

- Household trash fires on your home property—only if you don’t have trash pickup.

If you are planning a large outdoor burn, call the Texas Commission on Environmental Quality (TCEQ) at 888-777-3186. TCEQ sets the outdoor burn rules for Texas.

Most wildfires start from carelessness. Control your fire by putting trash, grass, leaves, and branch trimmings in a burn barrel or similar container. Top it with a screen or metal grid.

Also, keep water, a shovel, and a rake handy in case your fire starts to spread. Finally, stay by your fire until it’s out.

Items that shouldn’t go into a fire include aerosol cans or anything that could explode, electrical insulation, and building materials like treated lumber, and plastics and asphalt-based materials.

If you spot a dangerous fire, call 911.

For more information, visit the Texas State Fire Marshal’s Office, a division of the Texas Department of Insurance.

August 2025

Get a CLUE about the insurance history of a home or car

Need more information before you buy that home or car?

Check its insurance history by getting a CLUE report.

What’s the report? It’s the Comprehensive Loss Underwriting Exchange or CLUE report. It shows claims filed for homes and cars for the past seven years. Most Insurance companies report information based on filed claims, including:

- Date of loss.

- Loss type.

- Amount paid on claim.

How do I get a report? If you’re buying a home or car, you can ask the current owner for the report.

Each year, you can get a free report on property you own by contacting LexisNexis. You also can contact LexisNexis to dispute information in the report or to add an explanation.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

July 2025

Leave July 4 fireworks to the professionals

Love fireworks? To stay safe, let a professional light up your Independence Day.

State Fire Marshal Debra Knight advised: “If you want to see great fireworks, go to a pro show. Our office has issued many permits for communities to enjoy Fourth of July shows. You probably have one nearby.”

Another caution: Your county might be under a burn ban. Most communities don’t allow you to use fireworks within city limits or during burn bans.

Check with your local fire department to see what’s allowed.

“Also, there are no safe fireworks for children,” Knight said. “Some sparklers burn at temperatures of nearly 2,000 degrees, as hot as a blow torch.

“Celebrate,” Knight said, “and stay safe.”

Want to learn more about fireworks safety? Visit the State Fire Marshal’s Office website at www.tdi.texas.gov/fire.

June 2025

Five tips to be ready for a disaster

Everyone wants to be ready for a disaster.

Five easy ways to get started:

- Install a weather app on your phone. Turn on notifications or check it before bad weather to know what’s heading your way.

- Make a list or inventory of the stuff in your house. Email it to yourself or keep it online. Include item model and serial numbers. Take photos or videos of each room in your house, including closets and drawers. When you need to file a claim, the list and photos will help.

- Pack a “go kit” of supplies you can take with you if you need to leave in a hurry. Include water, food, clothes, chargers, medicines, and pet supplies. Have copies of your home, auto, and health insurance cards.

- Consider buying flood insurance. Most home insurance policies don’t cover flood damage; you’ll need a separate flood policy. Flood policies often have a 30-day waiting period before taking effect.

- Check that your insurance policies are up to date and provide enough coverage. Your coverage limits might be too low if you’ve built onto your house or bought furniture or electronics.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

May 2025

HelpInsure.com helps Texans shop for home and auto insurance

Want a quick list of some home and auto insurance policies sold in your area?

HelpInsure.com is a state-established website where you can search and compare policies from some Texas insurance companies, including the 25 largest insurance groups.

Answer some questions and the site shows policies sold in your area, sample rates, and information on the coverage provided by the policy. You’ll also find a company’s complaint record and financial rating— to help you find the right company.

Once you have your top choices, contact an independent agent or insurance company directly to get actual price quotes. And don’t forget to ask about discounts.

HelpInsure.com is a service of the Texas Department of Insurance and the Office of Public Insurance Counsel.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

April 2025

Why you should consider a flood insurance policy

Most homeowners insurance doesn’t cover damage from flooding after a storm.

And no matter where you live, you could face a flood.

Just an inch of floodwater can cause about $25,000 in damage to an average size home. If you don’t have flood insurance, you’ll have to pay for those repairs on your own.

So, consider shopping for a flood policy.

Homeowners who get a standard National Flood Insurance Program (NFIP) policy can insure their home for up to $250,000 and also cover up to $100,000 in belongings. Renters can also get NFIP coverage for up to $100,000 in belongings.

With hurricane season starting in June, now is a good time to contact your agent or insurance company about buying a flood policy. A policy usually starts 30 days after buying it, so don’t wait until a storm’s on the way

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

March 2025

Hail damage? Tips to file an insurance claim

Did hail or strong winds damage your home or car?

Your insurance company should pay for hail damage - if you have wind and hail coverage on your homeowners policy or comprehensive coverage on your auto policy.

File a claim quickly.

Other tips for getting paid:

- Take photos or video of the damage. Also, make a list of any damage inside and outside your house or car. Don't throw away damaged items until your insurance company gives permission.

- Prevent more damage. Remove standing water. Cover broken windows and holes to keep out rain. Save all receipts. Your policy may pay for temporary repairs.

- Be available for the adjuster. Make sure the adjuster sees everything.

- Keep a list of everyone you talk to at your insurance company. Be ready to answer questions about the damage.

- Ask about living expenses. If you can’t stay in your house, most policies will cover some related costs. Keep your receipts.

February 2025

What to know about replacing your roof with insurance

If bad weather damages your roof, your homeowners insurance might help you fix it.

Before you need to repair or replace your roof, ask your insurance company or agent these questions:

- Do I have replacement cost or actual cash value coverage? When you buy or renew your home insurance policy, ask how they pay for roof damage and replacement. Some policies pay the full cost to repair the roof. This is called replacement cost coverage. Most policies pay less if the roof is older or showing wear. This is called actual cash value coverage.

- Does insurance always cover roof replacement? If your roof is old or in poor condition, your company might not cover it. Ask your agent to explain your roof coverage. If you need to replace your roof, consider choosing materials resistant to wind, hail, and fire. You might qualify for a discount.

- What’s my deductible? A deductible is what you pay before your company starts paying. Your deductible for wind and hail damage can be more than the deductible for other types of damage. Ask what the dollar amount of your deductibles are.

- When should I file a claim? You can file a claim if a storm, tree, or something else damages your roof. Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

January 2025

Doing a home inventory now can get your insurance claim paid faster later

Keeping a list of stuff inside your house—or a home inventory—could help you make a homeowners insurance claim after a fire or disaster.

Most insurance companies will want a record of lost or damaged items before they pay a claim.

Many companies have apps or online forms to help you make a home inventory—or you can build your own by using your phone to take pictures or video of each room in your home.

Some tips:

- Open closets and drawers. Record serial numbers, model numbers and estimated values of valuable items like appliances and electronics.

- Check your garage or storage shed for tools, lawn equipment, and sporting goods.

- Store your inventory, receipts, and appraisals online, in a safety deposit box, or away from your home with a family member or close friend.

- Update your inventory regularly, especially after making big purchases.

How do you make a home inventory? Watch this video.

Have a question about insurance? Call TDI’s Help Line at 800-252-3439 or visit tdi.texas.gov.

December 2024

Winter fire safety from your kitchen to the backyard

From your kitchen to the backyard, be careful around fire.

Some winter fire safety tips:

- Enjoy candles with caution and always blow them out before you go to sleep. Keep candles at least a foot away from anything that could catch on fire. Never leave children alone in a room with a lit candle. Battery-powered candles are safest.

- Check electrical cords for all plug-in holiday lights. Replace damaged ones. Any cord used for outdoor lights should be designed for that purpose. Use clips, not nails, to hang lights. Nails can rip cords.

- Don’t leave the kitchen if you’re cooking on the stovetop. Never leave home with your oven on. Don’t use an oven to heat your house.

- Follow local regulations for fireworks or enjoy a professional show. Don’t use sparklers or fireworks near dry grass, brush, or other flammable materials. Keep a water-filled bucket or connected hose nearby. Never aim or throw fireworks at anyone.

Have a question about insurance? Call TDI’s Help Line at 800-252-3439 or visit tdi.texas.gov.

November 2024

Shopping for a health plan? How to avoid problems

With HealthCare.gov and Medicare open enrollment in full swing, many Texans are shopping for health plans.

Shopping for a plan can be complicated. You don’t want to get scammed or not get the coverage you need.

Shop smart

TDI’s shopping checklist has questions to ask before you buy a plan.

Confirm plan details

Premiums, provider networks, and plan details can change, so it’s a good idea to shop every year. Shopping tools can help you search for plans that cover your preferred doctors and drugs. Consider each plan’s deductible, copay, and coinsurance amounts. These are amounts you pay when you get services. Also look at what is covered before you meet your deductible.

To avoid problems:

- Shop from trusted websites like HealthCare.gov and Medicare.gov.

- Beware of salespeople who suggest an alternative health plan, instead of an Affordable Care Act (ACA) plan. Alternative plans have more limits and don’t cover existing health care conditions.

- Some websites or salespeople use terms like gold, silver, or bronze to make plans sound like ACA plans. But a plan might have fewer benefits or not meet ACA coverage expectations.

Be cautious of cold calls and scams

If you didn’t make the phone call about a plan, don’t give away any personal information, including Social Security, Medicare, or banking, credit card or account numbers. If you’re interested in a plan, ask for all information in writing.

Other ways to protect yourself:

- Remember that scammers can “spoof” a phone number to make it show up as another business on caller ID.

- Beware of ads on social media or elsewhere online offering you gifts. The personal information you share could be used without your permission.

- Be suspicious if anyone tries to pressure you to buy quickly. There are no “special deals” on health plans.

Call TDI’s Help Line at 800-252-3439

TDI can help with questions about coverage options, insurance companies, and agents we regulate.

October 2024

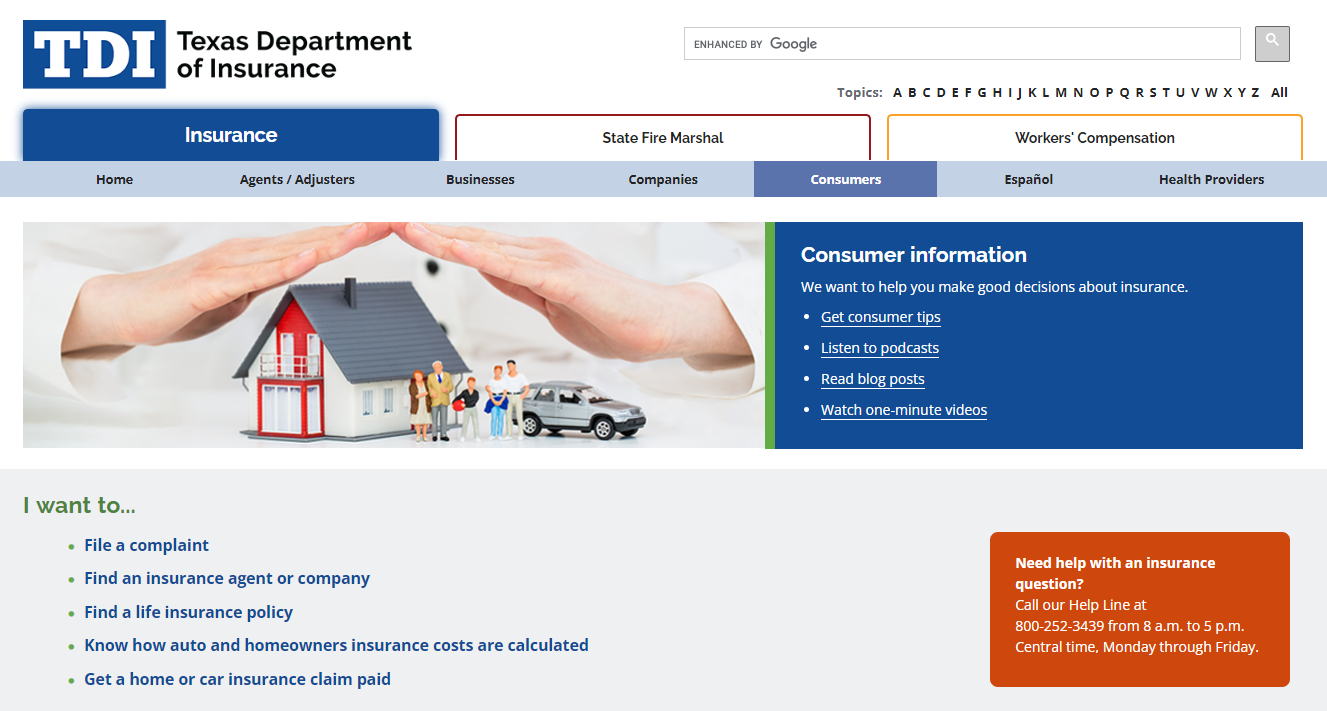

Expert insurance help for Texans

Looking for information about insurance?

We got you.

Check out a range of consumer tips, videos, blog posts and podcasts from experts at the Texas Department of Insurance—all available in Spanish too.

On your phone or computer, go to tdi.texas.gov. Next, click the “Consumers” tab near the top of the page. Or for Spanish, click “Español.”

You’ll find resources including:

- How to find an insurance agent or company.

- Tips for saving money on auto or homeowners insurance.

- How to file a complaint.

Have a question about insurance? Call TDI’s Help Line at 800-252-3439 or visit tdi.texas.gov.

September 2024

How to spot changes in your homeowners or windstorm insurance

If you’re renewing or changing your homeowners or windstorm insurance, make sure to check for possible costly changes.

Some tips:

- Read the declarations, or “dec page" of your policy. It shows the dates your policy is in effect and the amounts and types of coverage. It also lists the dollar amount of each deductible – that’s what you have to pay if you need to make a claim before your insurance pays.

- Ask your agent if your deductible is staying the same or changing. A common deductible amount is 2% for wind or hail damage and 1% for other types of damage.

- If you’re renewing your policy, look at the last pages of the renewal to see if there are new endorsements or exclusions. If you see anything you don't understand, ask your agent or company to explain.

Have a question about insurance? Call TDI’s Help Line at 800-252-3439 or visit tdi.texas.gov.

August 2024

How to safely run your portable generator

A portable generator can make a big difference during a power outage.

Follow these tips to use your generator safely:

- Read the generator’s owner’s manual to avoid dangerous risks.

- Run the generator outdoors at least 20 feet from your home’s doors, windows, or vents. You don’t want to breathe in carbon monoxide gas, which is colorless, odorless, and deadly. Wind can blow carbon monoxide inside. Never use a generator in a garage, even if the door is open.Turn your generator off and let it cool before refueling.

- Don’t store fuel inside your home.

- Use a heavy-duty, outdoor-rated extension cord to power appliances connected to the generator.

- If you want to connect your generator to your home’s wiring, hire a licensed electrician. Make sure the electrician uses a properly rated switch that meets electrical codes.

- Make sure you have a working carbon monoxide detector in your home, even if the generator stays outside.

Have a question? Call the Texas State Fire Marshal’s Office at 512-676-6988 or visit www.tdi.texas.gov/fire.

June 2024

You affect your home and auto insurance costs

Each insurance company uses many factors to calculate what they charge a customer.

Some factors are about you, your home, or your car.

For home insurance, common factors include:

- Your home’s age.

- How old your roof is and what it’s made of.

- Where you live.

- The cost to replace your house.

- Your claim history.

- Your credit score.

For auto insurance, common factors include:

- Your driving record and claims history.

- Where you live and how much you drive.

- Your age, gender, and marital status.

- Your occupation.

- The cost to replace the car you drive.

- Your credit score.

A change in any factor can raise or lower your premium. This includes characteristics that change over time, such as the value of your home or auto.

The Texas Department of Insurance (TDI) doesn’t have information about your policy or what factors caused your premium to change. Your company should be able to tell you why it raised your premium.

Have a question about insurance? Call TDI at 800-252-3439 or visit www.tdi.texas.gov.

May 2024

Outside factors affect home, auto insurance costs

Numerous factors affect the cost of claims that insurance companies pay as their obligation under an insurance policy.

These factors include:

- Inflation, which can affect the cost of new and used vehicles, car parts, and repairs. It can also increase the cost of building materials and construction labor. Supply chain disruptions can affect the flow of construction materials and car parts from around the world.

- Riskier driving, which results in more severe and costly accidents. As companies pay more claims (and higher vehicle repair and replacement costs), they’re more likely to raise rates to make up for those costs.

- Weather events, which in Texas include freezes, hurricanes, hailstorms, tornadoes, wildfires, major thunderstorms, and more. The frequency and size of these events add to claim costs.

- Reinsurance, which is a form of insurance for insurance companies. Companies buy reinsurance to spread their risk and be financially stable if a major disaster occurs. Higher reinsurance rates affect what insurance companies charge customers.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

April 2024

State doesn’t set your insurance premiums

Consumers often tell the Texas Department of Insurance (TDI) that their insurance company or agent told them that their premium went up because the state made them raise rates. TDI doesn’t set the homeowners or auto insurance rates that your insurance company charges.

Insurance companies can change their rates and premium formulas by sending them to TDI. This is called a “rate filing.” Companies can use the new rates as soon as they send them to TDI.

Companies are required to provide an analysis that supports the rate changes they file. TDI staff review the analysis and ask for more information, if needed, to evaluate whether the rate changes are supported and follow state law.

By law, rates must be adequate; not be excessive; be based on sound actuarial principles; be reasonably related to all costs; and not be based on the insured’s race, creed, color, ethnicity, or national origin.

If your auto or home insurance bill is rising, ask your company to explain the increase and if you’re getting all available discounts.

You might want to shop for a better deal.

You can start your search at HelpInsure.com to get sample estimates. Then call companies to get price quotes.

You might want to call an independent insurance agent. They can help make sure you’re comparing the same type and amount of coverage.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

March 2024

Five steps to getting your insurance claim paid

Tips for getting your insurance claim paid:

- Make your claim. Submit your claim, along with photos and videos of all damage, to your insurance company or someone else’s company. Start by telephone or email—or go online or use a company app. Keep receipts for all your expenses.

- Answer questions. The insurance company will ask follow-up questions. Answer fully and quickly. You might see an adjuster in person. If you do, get their name, phone number, and email address to have handy. Take notes on every communication.

- Be aware of deadlines. Your company has 15 business days to say it’s received your claim. It has 15 more days after getting all the information it needs to decide if it’ll pay. If your claim is rejected, the company must say why in writing. If your claim is with someone else’s company, that company doesn’t have the same time limits, but should treat you fairly.

- Choose a contractor. You may take your car to any repair shop. If you’re choosing a contractor, get bids from several. Don’t sign any contract with blank spaces. Don’t pay in full up front.

- Get paid. If you’re using your own insurance, your company will subtract your deductible from your claim payment. You owe the deductible to the contractor or repair shop. Once an insurer agrees to pay, it has five business days to get at least part of the payment to you. If your claim is with someone else’s company, there’s not a time limit, but it should try to make a prompt and fair settlement.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

February 2024

Ready to get in shape? Your health plan could help

You know that your health plan backs medical care.

Your plan also might help you get fit.

Check your plan’s website or call your agent to see if your plan offers:

- Free or discounted weight loss or wellness programs.

- Free or discounted programs to help quit cigarettes and other tobacco products.

- Discounts on gym memberships.

- A free app to help you count steps and track your fitness.

Your plan also might have discounts on personal training, massage, and acupuncture.

Similarly, your workplace might have wellness incentives. Some employers offer coaching by phone or health screenings. Check with your human resources department.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

January 2024

Space heater on? Know these safety tips

A space heater is a great way to warm yourself up in the winter months if you go about it safely.

“We see several fatal fires around this time of year that involve a space heater,” said Debra Knight, the state fire marshal. “Most of them are accidental and could have been avoided by following some basic safety steps.”

To avoid setting an accidental fire with a space heater, follow a few safety tips:

- Inspect the heater to make sure it has no loose wires or cracked or broken plugs. If so, replace the heater.

- Always plug your heater directly into a wall outlet. Avoid extension cords or power strips.

- Reduce risk by keeping your heater at least three feet from anything that can burn, including furniture, blankets, or mattresses.

- Turn off your heater before you leave the room or go to bed. The best way to be sure: Unplug it.

- Never use or store flammable liquids in the same room as a space heater. And because heaters are electric, don’t get near one when you’re wet.

Heating equipment, including space heaters, are the third leading cause of home fire deaths behind smoking materials and cooking. Space heaters account for more than 15% of all home fire deaths.

Have a question about insurance? Call the Texas Department of Insurance at 800-252-3439 or visit www.tdi.texas.gov.

These columns by the Texas Department of Insurance are available for use in publications. They may be edited as needed and used without copyright. For questions, contact TDI media relations at 512-676-6595 or MediaRelations@tdi.texas.gov.