March 26, 2024

Insurance tips for new graduates

If you’re graduating and moving into your own house or apartment, there’s a lot to consider. Here’s what you need to know about insurance.

Protect your stuff: Renters insurance pays for your clothes, furniture, electronics, and other belongings if they’re stolen or damaged by a fire or other cause. Most renters policies also pay for your belongings if they’re stolen from your car.

Shop for auto insurance: If you need your own auto insurance, use TDI’s HelpInsure.com to compare rates and policies. Then ask several companies for quotes. Also ask if you qualify for any discounts.

Finding health insurance: If you have a job that offers health insurance, that’s great. Be sure to ask if your doctors are in its network to avoid a big bill. Also look at the plan’s website to find hospitals and urgent care centers near you for when you need a doctor after hours.

Learn more

- Renters insurance: What does it cover and how much does it cost?

- 10 steps to find the right auto insurance

- Need health insurance? How to find a new health plan now.

March 14, 2024

Any place can flood. Do you have flood insurance?

It can rain and flood anywhere. Your homeowner or renter’s policy doesn’t cover flood damage. You might want to buy flood insurance.

One inch of water in a home or apartment can cause up to $26,000 in damage.

To shop for coverage, talk to your insurance provider. If they don’t offer a flood policy, go online to floodsmart.gov to find providers.

A flood policy takes effect 30 days after purchase. It’s wise to shop before hurricane season, which begins June 1.

Get expert advice on flood insurance in this Texas Insurance Podcast.

Learn more

- Flood insurance: Why you need a policy

- You live in a flood plain

- Hurricane season: How to prepare your home and property

January 17, 2023

Texas law encourages renters to buy flood coverage

A Texas law (House Bill 531) emphasizes that renters insurance doesn’t pay for flood damage.

Renters insurance, available for about $20 a month, pays to repair or replace the things you own if they’re damaged by fire, smoke, theft or vandalism, and certain kinds of water damage.

But renters policies don’t pay for losses caused by floods.

Renters worried about flooding should consider buying a separate flood policy. Ask your agent if they sell flood insurance. If not, you can buy a policy from the National Flood Insurance Program. You can also call them at 800-427-4661.

Landlords are now required to:

- Tell potential renters if they know the dwelling is in a 100-year flood plain.

- Tell potential renters if they know the dwelling had flood damage at least once in the previous five years.

- Encourage renters to buy flood insurance.

Even if your home isn’t in a flood plain, you might want to consider a policy. Flooding can happen anywhere at any time. Poor drainage systems, broken water mains, neighborhood construction, and summer storms can result in flooding.

Learn more

- Flood insurance: Why you need a policy

- Renters insurance: What does it cover and how much does it cost?

- Why you need flood insurance (video)

- Why you need renters insurance (video)

July 28, 2022

Thinking about buying a residential service contract? It’s not home insurance.

When you’re buying a home, you also might be asked if you want a residential service contract. They’re sometimes called a home warranty.

These service contracts are different than home insurance. Insurance pays for damages from events your policy covers like fire or theft.

A residential service contract covers certain items in your home when they break down from normal wear and tear. (Home insurance doesn’t pay for wear and tear.) Depending on your contract, you may get coverage for appliances, such as stoves and refrigerators, to water heaters, electrical and plumbing systems, and even swimming pools.

Residential service contracts can bring peace of mind about the machines and systems that keep your home comfortable. Not all service contracts are the same, though. Remember to carefully read the contract before signing up.

Under Texas law, companies that sell residential service contracts must be licensed by the state.

In our latest video, we spoke with Elizabeth Salinas-Strittmatter with the Texas Department of Licensing and Regulation (TDLR) about how residential service contracts work.

Learn more

- List of TDLR-licensed residential service companies

- Five things your home policy won’t cover

- Do you have enough home insurance?

August 12, 2021

Got insurance? Questions to ask at a job interview

Congrats, you got a job interview! After you talk about pay and telecommuting, don’t forget to ask about the benefits. And we don’t mean days off – we mean insurance.

On average, benefits make up a third of a company’s compensation package, according to the U.S. Bureau of Labor Statistics. Health insurance is a big part of that.

Ask if the company offers health insurance and how much of the premium you’ll pay. Also ask if they offer health insurance for your family. And look at the plan’s copays, deductibles, and coinsurance. Those are all amounts you’ll have to pay yourself.

If you already have health insurance, getting it through your job will probably cost less and offer more benefits. But always compare costs and benefits before you switch.

If a company doesn’t offer health insurance, ask if there’s a health savings plan. It’s a plan you pay into to help with the cost of health care.

Learn more about what to ask about insurance before you switch jobs.

July 27, 2021

Before starting your home business, check on insurance needs

Starting a business? You may have new insurance needs even if you’re working from home.

Texans are starting businesses at a faster clip. More than 250,000 businesses launched in the state the first half of 2021 — up from 152,000 the first half of 2020, according to federal statistics.

If you’re starting a business at home, your homeowner’s policy might not cover your equipment, products, or injuries to employees and customers. Some coverages worth exploring:

- Coverage of expensive equipment, special tools, or inventory.

- Business interruption coverage to make up for lost income if your business is put on hold after a break-in, storm, or fire.

- Data breach or cyber liability coverage — especially if you store anyone’s personal data.

- A commercial auto policy if you make deliveries or regularly need to pick up supplies.

- Workers’ compensation coverage, additional liability coverage, or an umbrella liability policy in case an employee or customer has an accident in your home.

Ask your agent or insurance company if you can bundle coverages into a business policy to save money.

Read our updated tips: What insurance do I need to run a business from home?

Watch our video on what you need to know about business insurance.

June 21, 2021

RV, pool, or boat? Insurance for your summer survival tools

Texans typically use the heat index instead of the calendar to mark the arrival of summer. Whether you wait for a 100-degree day or the official summer solstice, summer is here. Stay cool, Texas. We’ve got ideas to beat the heat and make sure your investment is insured.

Hit the road: RV sales are skyrocketing. If you’re part of this growing trend, watch our video to understand how insurance works for your home on wheels.

Hit the pool: Thinking about adding a pool or outdoor kitchen to your home? Yes, please! It’s a big investment, so talk to your insurance agent or company about getting the right coverage.

Hit the lake: With thousands of lakes and 367 miles of coastline, no wonder Texas is home to more than half a million recreational boats. If you have a small boat, your homeowners insurance may include enough coverage. To make sure, check our tips on boat insurance.

April 15, 2021

What FEMA covers and how to apply

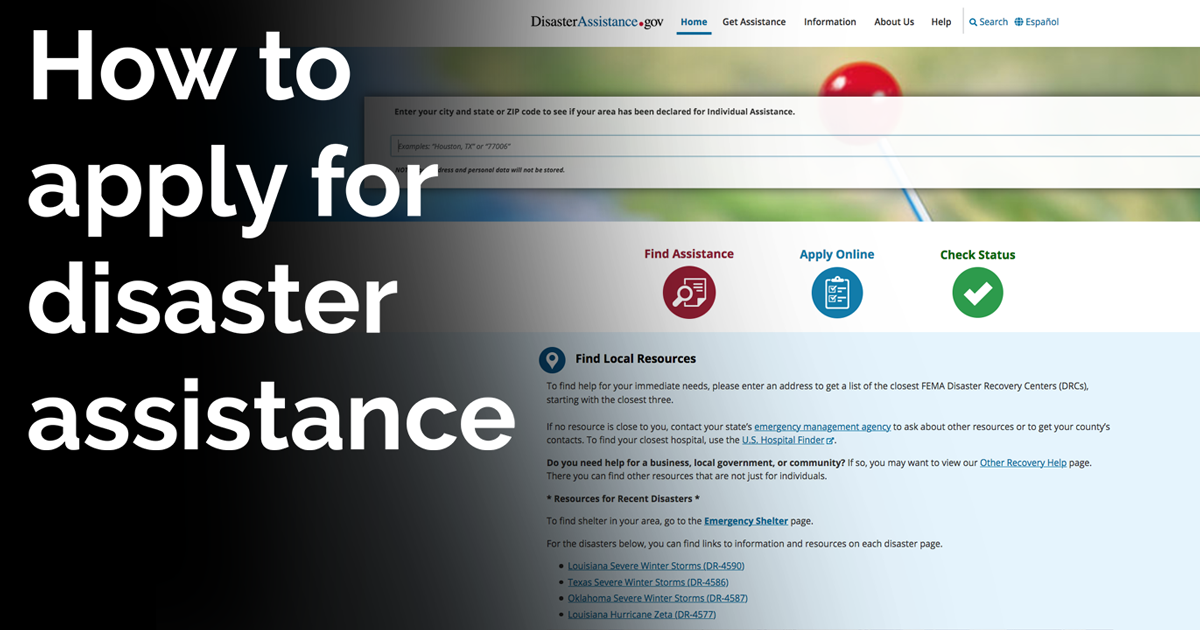

Are you still dealing with repairs or extra expenses from the February winter storms? Homeowners and renters who have damage or other storm-related costs not covered by insurance can apply for federal disaster assistance. To learn more about what FEMA covers and how to apply, we talked to FEMA’s Kurt Pickering. (Update: The application deadline was extended to May 20 after we posted the interview.)

FEMA may cover expenses beyond repairs to your home. Help also may be available for temporary housing, to repair storm damage to your primary car, for extra child-care expenses, or to replace medications or medical supplies.

FEMA rental assistance may be available if you need to rent a different place while repairs are made to your rental home. Rental grants may be used for security deposits, rent, and utilities. FEMA can also help renters replace or repair damaged personal property, such as furniture, appliances, clothing, school supplies, and job-related equipment.

To apply, visit DisasterAssistance.gov or call 800-621-3362.

Insurance tips and help

How to get help or file a complaint: We can answer insurance questions, help with problems, and explain how to file a complaint against an insurance company or agent.

Videos: Our video library has short tips and interviews with experts on dozens of topics.

Insurance tips: Use our tips to get the best deal on insurance, protect yourself from fraud, and learn what to do when you have a problem.