This report presents system trends that allow the Division of Workers’ Compensation, policymakers, and system stakeholders to gauge the relative health of the Texas workers’ compensation system and consider whether additional legislative changes are necessary.

Published: December 2022 by the Division of Workers' Compensation.

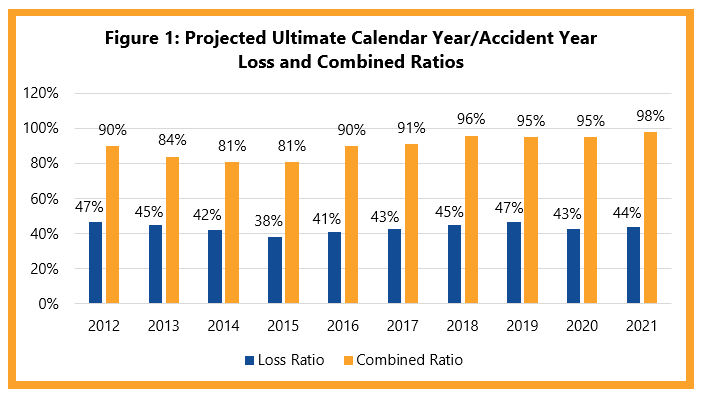

Overall, the last decade has been profitable for insurance companies writing workers’ compensation insurance in Texas.

Since 2003, workers’ compensation insurance rates have dropped nearly 77%.

In 2021, the projected accident year combined ratio for workers’ compensation in Texas was 98%. This means that, for every dollar an insurance company collects, it will pay an estimated 98 cents to cover losses and expenses and keep the remainder as profit. Figure 1 shows the projected workers’ compensation loss ratio and the combined ratio for the last decade. Insurance companies writing in Texas also averaged a 10% return on net worth (net income after taxes to net worth) over the last decade, which outperforms the national average of 8.8%.

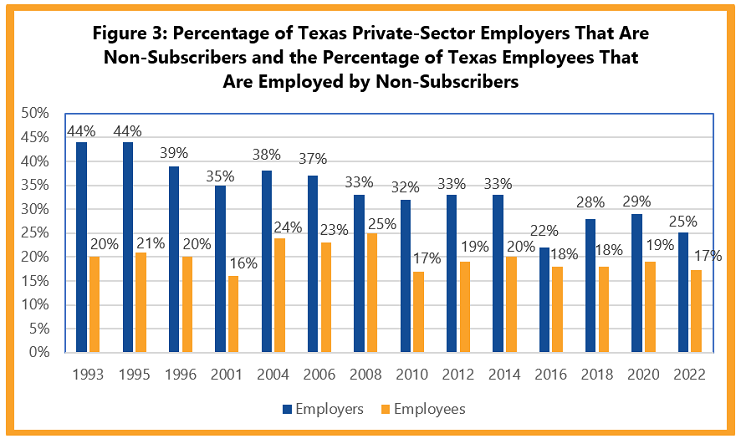

Texas is the only state that allows private-sector employers the option of not purchasing workers’ compensation insurance or becoming “non-subscribers” to the state system. It has been this way since 1913.

In 2022, the percentage of employers that were non-subscribers (25%) was the lowest in six years (Figure 3). The percentage of Texas employees working for non-subscribing employers (17%) was the lowest in 12 years.

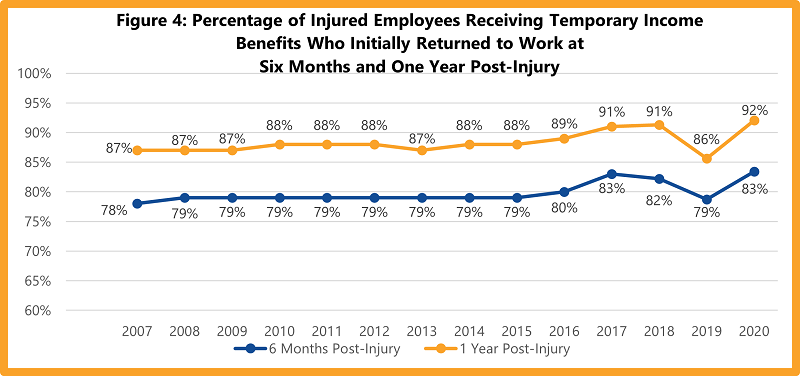

Return-to-work rates have steadily improved for Texas injured employees in the last decade. Figure 4 shows that 83% of employees injured in 2020 returned to work within six months, and 92% went back to work within the first year after their injury.

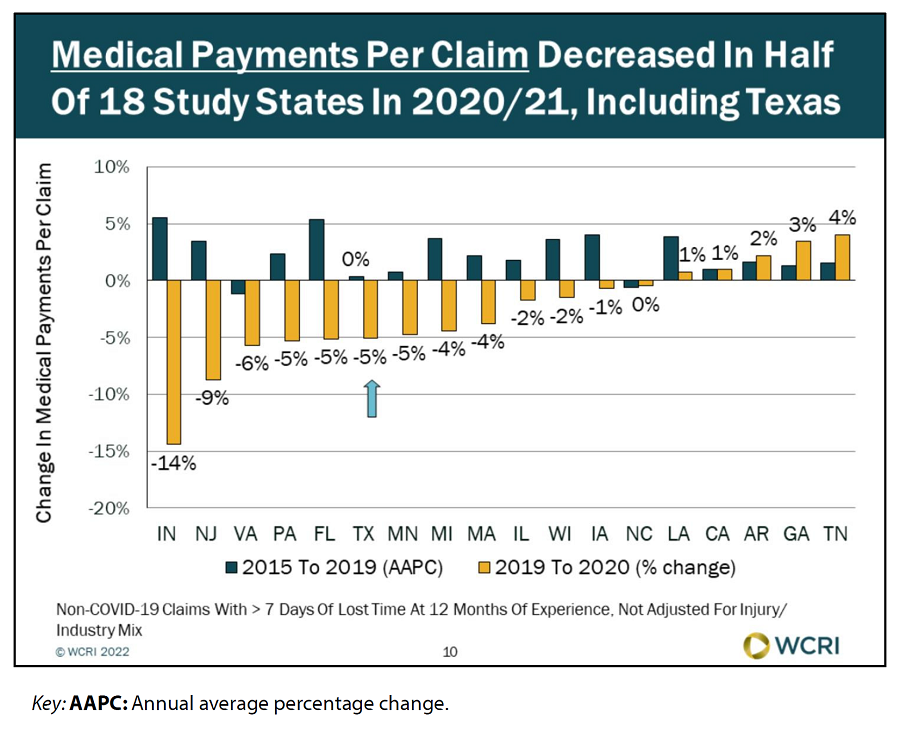

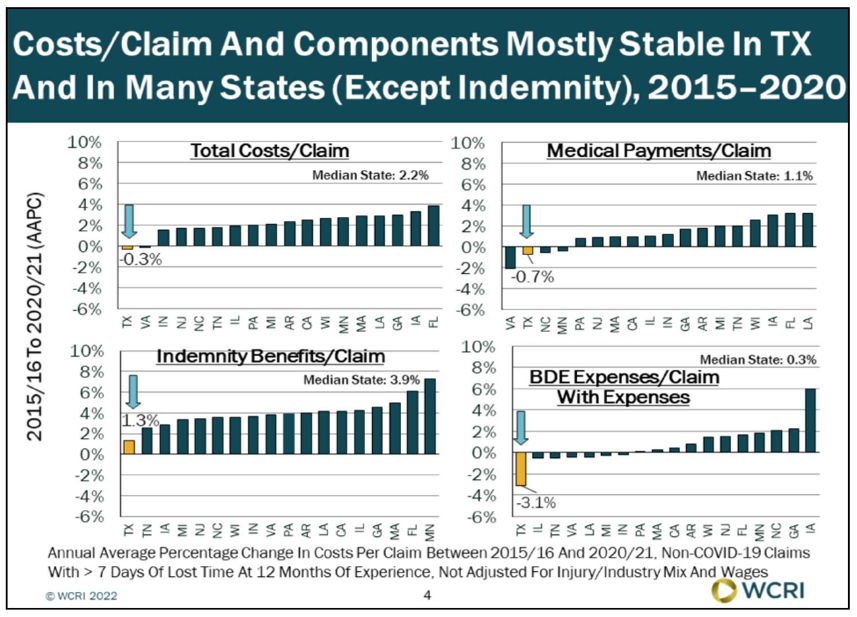

Recent data from the Workers’ Compensation Research Institute’s annual Benchmarks for Texas report shows total costs per non-COVID-19 claims with more than seven days of lost time at 12 months post-injury decreased 3% per year from 2015 to 2016, followed by an increase of 4% per year from 2017 to 2019, and a 3% decline in 2020. Medical payments per claim and indemnity benefits per claim were stable, while benefit delivery expenses (BDE expenses) per claim have decreased moderately at about 3% per year. Benefit delivery expenses include expenses for managing medical costs and litigation-related expenses on individual claims.

In 2005, the Texas Legislature made several statutory changes to address Texas’ high medical costs and poor outcomes for injured employees including:

- adopting evidence-based treatment guidelines;

- creating a pharmacy closed formulary; and

- certifying workers’ compensation health care networks.

Since then, total medical payments have declined in the system. This is primarily due to fewer claims needing treatment and less costly medical care.

In a recent Workers’ Compensation Research Institute study, Texas was 22% lower than the 18-state median for 2018 claims at 12 months post-injury, declining by 5% in 2020 alone. The decrease was driven mainly by a decrease in the share of claims with payments greater than $100,000.