Business owners have many decisions to make, including whether to provide workers’ compensation coverage to their employees. Texas is the only state that gives private-sector employers that choice. Businesses that provide workers’ compensation coverage are called “subscribers.” Those who do not are called “non-subscribers.”

The premise of workers’ compensation is based on the Grand Bargain, a compromise between employers and employees that began to take hold nationally in the early 1900s.

This system, designed during the Industrial Revolution, protects employers from potentially crippling lawsuits brought by injured employees. In return for giving up their right to sue, employees are entitled to prompt medical treatment for their work-related injury or illness and income benefits to replace some of the wages they’ve lost. The system also includes income benefits for beneficiaries of an employee who dies from a work-related injury.

The Texas Department of Insurance, Division of Workers’ Compensation (DWC) doesn’t pay benefits to injured employees. Our main role is to regulate the system and settle claim disputes between parties.

We also:

- Guide employers through the claims process when an employee is hurt.

- Help Texas employers create a safer workplace for their employees.

- Educate businesses about the system.

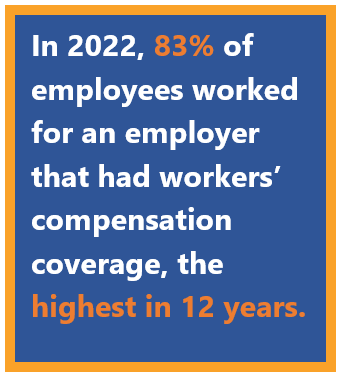

DWC also monitors the health of the workers’ compensation through our Research and Evaluation Group. Our latest research shows that in 2022, 83% of private-sector employees worked for an employer that had workers’ compensation coverage, the highest in 12 years.

Most employers who chose not to get workers’ compensation coverage do carry alternative benefit plans, some of which are regulated by the Employee Retirement Income Security Act.

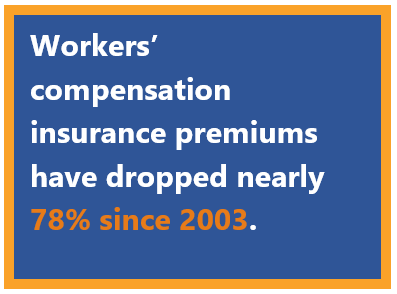

More employers are choosing to buy workers’ compensation coverage mainly because the cost of premiums has dropped nearly 78% since 2003. Right now, the cost is $0.51 per $100 of payroll.

Workers’ compensation is like other insurance. You don’t know you need it…until you do.

While having workers’ compensation coverage ensures your valued employees get medical treatment and replacement of some of their lost wages, there are other benefits. An experienced workers’ compensation insurer can help you reduce lost productivity by getting your injured employees back to work faster and work with you to limit future claims to keep your premiums low.

Regardless of an employer’s decision to get workers’ compensation insurance, every Texas employer must report their coverage status to DWC every year between February 1 and April 30.

Find more info about:

For more information contact DWCCommunications@tdi.texas.gov.